Employee Identification Number (EIN)

Steps to setup your store’s EIN ID

If you are a small business owner, it might be confusing if you need a federal business tax ID. It also goes by the name of Employee Identification Number. An EIN is a unique nine-digit ID number that identifies you or your business. The Employee Identification number may be used for all your federal tax filings and in sometimes it may be used for state tax purposes. You can use it on all forms related to tax filings. You can also use it when you require permits, licenses or registrations. It is a common practice for people to require an EIN when they are opening a business bank account. This helps keep your business and personal finances separate.

In the modern era, people can now get an EIN from the IRS online. There are steps that you would have to take in order to get an EIN:

Make sure you really need one

The only time that you should get an EIN is if your e-commerce store is in the United States and its territories. You will have to withhold taxes when paying your employees wages. An EIN number is also important for other forms of entities such as trusts, estates and Nonprofit organizations. It is also necessary to get an EIN if you operate a business as partnership or corporation.

Apply for an EIN

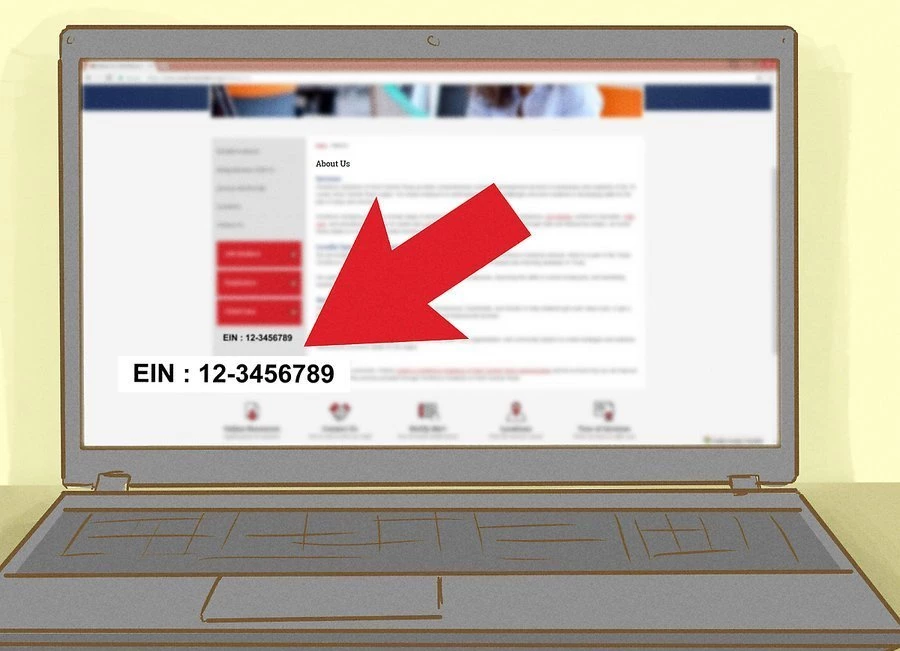

You can submit your EIN application physically, or online. The IRS prefers that you apply for your EIN online. Through applying for EIN online you will receive your EIN immediately after completing your application. All you need to do is visit the IRS websites and click on Apply for an Employer ID Number. This launches the EIN Application process. Next, you need to click on the Apply online button which will begin the online application process.