e-commerce stocks crushed it in 2017.Will 2018 be a repeat?

E-Commerce stocks crushed it in 2017.Will 2018 be a repeat?

The ongoing competition among retailers will benefit the investors this year. Here are the reasons why?

2017 will be remembered as a successful year in the world of stocks in the U.S stock market since the key indexes gained a minimum of 19%. But the highest position holder was the e-commerce stocks among them all.

In the stock’s sector, the major players were some largescale online retailers like AMAZON.com (NASDAQ: AMZN), (ETSY: NASDAQ) and important suppliers like XPO Logistics (NYSE: XPO) and Shopify (NYSE: SHOP)

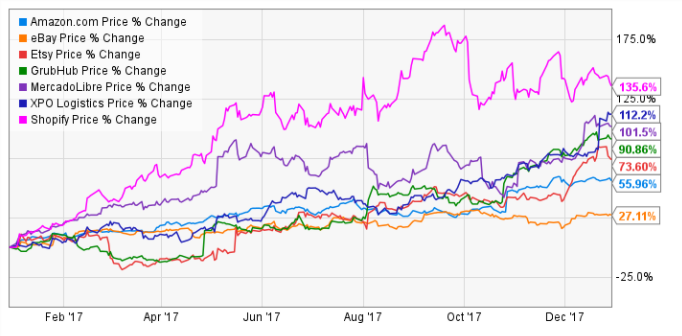

Then the performance of last year’s trending e-commerce giants can be seen in the graph below.

The rise in the stocks was due to different reasons for all the stocks mentioned. The takeover of the new CEO in Etsy changed things for them as large investors tried to get hold of some seats on the board of director’s tables given the future anticipation. The shares of XPO started going up as Home Depot was rumoured to buy the company. Moreover optimistic sentiments of various investors in the rising potential of the companies gave way to their rising stock values.

There has been a sufficient increase in the revenues of some industries like Shopify which observed a 72% increase in a time span of a quarter. MercadiLibre (NASDAQ: MELI) experienced a rise of 60% in its revenues.

The question is where the industrial performance is already outperforming how far are the investors expecting this stretch to last?

The greater Picture of e-commerce

E-commerce is attracting a larger part of the retail sales in the stocks market and the shares are known to have increased by 15% since the financial crisis. In the third quarter of 2017 the total amount of retail sales accounted for e-commerce markets were 9.1% , reported the census board. By looking at the numbers it is safe to assume that e-commerce can be expected to perform well in the coming years. If we assume that the online sales double over the time, they still would not add up to 20% of the total. U.S retail sales jumped up to $5 trillion last year and $5.7 trillion when bars and restaurant sales were included concluding that Amazon it maintains the trend, it is this factor that makes Amazon one of the most valuable industries in the world and it is alarming to see that it’s still growing Fast.

However, we should not assume that all physical market sales will convert into online channels over time. There are some sectors of the economy that have maintained their position as a physical element in the market such as restaurants, supermarkets and home improvement, although some of them have opened up to the option of online channels like Walmart, Starbucks and Home Depot.

Then there are products like gasoline which accounts for sales of $455 billion but where the delivery of the product through e-commerce is not a practical idea.

There is a large market that can be converted to e-commerce sales, there are different areas that can be tapped in and converted to online channels and so its safe to assume that the e-commerce market can be seen growing in the future. It can be said that there can be an increase in E-commerce sales by 15% every year.

The Amazon effect

While talking about e-commerce industry mentioning Amazon is unavoidable. Not only has it toughened it out for traditional retailers but it has managed to become a great threat to its e-commerce peers. For example, Amazon now deals in handmade items. It is giving Etsy a straight out competition to Etsy. By entering the restaurant delivery business it has cut down customers for Grub Hub (NYSE: Grub) which is known to be at the top in online restaurant ordering. There came a time when Amazon was competing against Shopify but later shut the project down opting to become partners with them instead.

By entering the Brazilian market it gave competition to another competitor MercadoLibre by planning to build its own shipping fleet. Judging the speed of its expansion it could be expected that Amazon could challenge XPO logistics which is known to be the leader in last mile delivery.

Investors need to know that by looking at the state of developments in the E-commerce industry as a whole we can see significant success but at an individual level, we can see some downsides to it as well as companies like Etsy and Grub Bub try to beat the competition produced by Amazon. In this scenario, a better option will be to invest in a pool of stocks rather than just investing in two or three as this diversification might help evade losing profits on one side.

The Valuation question

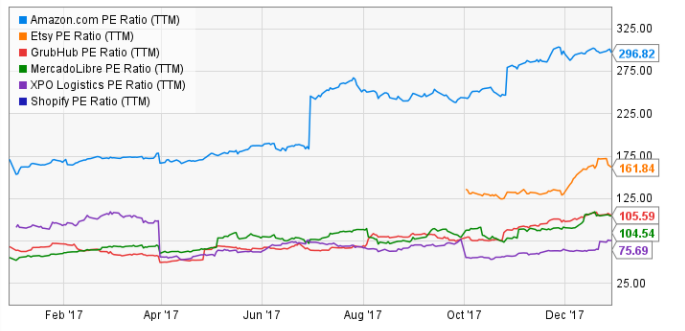

It can be seen in the chart below that the P/E ratios went up for most of the stocks last year the reason for which was the gains in stock prices due to growing revenues and market anticipation rather than the increases in profits.

Investors have an opinion about Amazon, they think that the company has strong competitive advantages and that they are willing to move with it. Optionality and moats are a more valuable consideration in comparison to valuations, especially where a bulls market is concerned because here the investors don’t want to miss an opportunity they can cash and that also a big one.

By looking at the current performance of the U.S and global economy we can see that they are operating at full capacity. It can be said that 2018 will be another successful year for e-commerce stocks.